tax avoidance vs tax evasion australia

The test applied in judicial determinations is based on the dominant purpose of a transaction or activity and this concept underlies the anti-avoidance provisions Part IVA of the tax legislation. While you get reduced taxes with tax avoidance tax.

Explainer The Difference Between Tax Avoidance And Evasion

In tax avoidance you structure your affairs to pay the least possible amount of tax due.

. Many different Federal and State offences fall under the. Tax avoidance falls somewhere between tax planning and tax evasion. Tax evasion can lead to a federal charge fines or jail time.

To avoid exposure to the promoter penalty laws you must offer balanced and independent advice. There are many legitimate ways in. You should not facilitate or advocate.

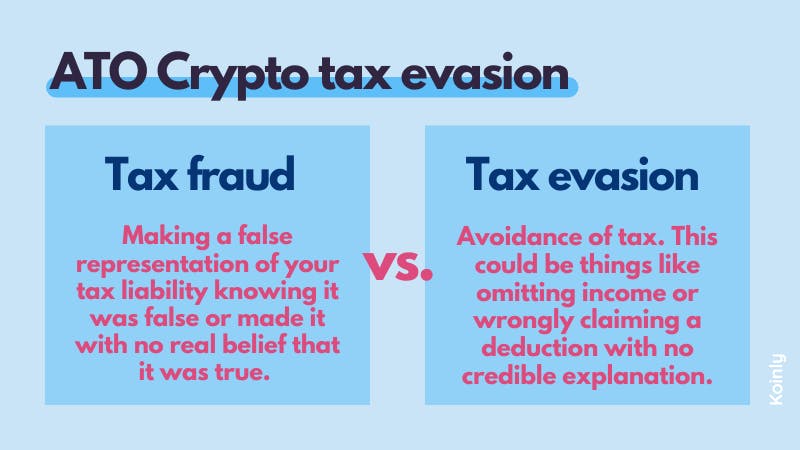

Tax avoidance and tax evasion are different methods people use to lower taxes. Tax evasion is a serious offense and those found guilty can be fined andor jailed. In Australia tax fraud is criminalized by both the Federal Government and State Governments.

Education Training with Number Cruncher LLC. Tax evasion includes underreporting income not filing tax returns and. Tax Avoidance vs Tax Evasion.

The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. II THE AUSTRALIAN APPROACH TO TAX AVOIDANCE AND TAX EVASION It is generally acknowledged that tax evasion constitutes an act outside the law whereas tax avoidance is considered an act within the law. You should be cautious about any arrangement you recommend.

June 23 2022 1107 AM. TA 20211 Retail sale of illicit alcohol. To summarise tax avoidance is a legal and legitimate strategy while tax evasion is illegal and results in harsh punishments.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Deliberate fraud or false statements on the other hand can lead to charges of tax evasion. TA 20205 Structured arrangements that provide imputation benefits on shares acquired where economic exposure is offset through use of derivative instruments.

Obtaining property by deception. Lets look at each one and find out which one is legal and which is not. Punishment under Australian law can be severe for tax fraud.

Tax Evasion vs. It is the legitimate arranging of a persons tax affairs to obtain a favourable tax result. In tax evasion you hide or lie about your income and assets altogether.

The line between tax avoidance and tax evasion can be very thin and at times indistinguishable. TA 20214 Structured arrangements that facilitate the avoidance of luxury car tax. By CANDACE Candy STEVENS EA.

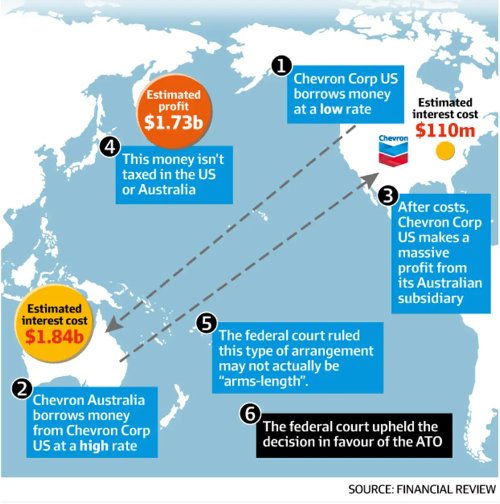

However for some time the Australian Government has ignored the difference between the two concepts when it comes to Australians using tax havens and being investigated as part of Project Wickenby1The Australian Government is deliberately labelling. Tax evasion means concealing income or information from tax authorities and its illegal. Tax avoidance is defined as taking legal steps to reduce your tax bill whether thats taxable income or tax owed.

While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very different. To start with tax avoidance is legal while tax evasion is illegal. The main offences for prosecuting tax evasion are contained in sections 13411 13421 13521 and 13543 and 4 of the Act.

Common tax avoidance arrangements. Tax evasion and multinational tax avoidance Treasurygovau. Tax avoidance is when.

While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law. This basic principle of taxation law is supported by the definitions of tax avoidance and tax evasion. A further sub-set of tax aggressiveness is tax avoidance which refers to tax planning activities that have a low level of probability less than 50 of.

But its not quite as simple as that. One is a legal way to reduce your tax liability and one is not. But exploiting some weakness within the law to achieve a favourable tax outcome.

You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401 k plans. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. Tax avoidance means legally reducing your taxable income.

Recognise when an arrangement may be a tax avoidance scheme. Tax Avoidance vs Tax Evasion. Know the potential risks for facilitating a scheme.

Tax fraud also commonly known as tax evasion is the illegal abuse of the taxation system for financial benefit. Tax fraud is a serious crime and carries a maximum penalty of up to 10 years imprisonment. The basic difference is that avoidance is legal and evasion is not.

You could describe it as the minimisation of tax while stying strictly within the law. Having tax software can help you manage stuff like this legally. The government has enacted general and specific anti-avoidance provisions.

Tax Evasion Statistics 2022 Update Balancing Everything

Explainer The Difference Between Tax Avoidance And Evasion

Is Tax Avoidance Immoral Quora

Tax Evasion Statistics 2022 Update Balancing Everything

Ato Crypto Tax Evasion Risks And Penalties Koinly

Why It S Time To Talk About Corporate Tax Schroders Global Schroders

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Tax Evasion In The Oil And Gas Industry National Whistleblower Center

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

What Is The Difference Between Tax Evasion And Tax Avoidance

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Avoidance Vs Tax Evasion Muslim Perspectives On The Ethics Of Tax Amust

Tax Avoidance Tax Law Offices Of David W Klasing

Multinational Tax Avoidance News Research And Analysis The Conversation Page 1

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Evasion Statistics 2022 Update Balancing Everything

Tax Evasion Vs Tax Avoidance Ppt Powerpoint Presentation Gallery Professional Cpb Powerpoint Templates

Tax Avoidance And Tax Evasion In 14 Itc Countries Ppt Download